Credflow

What is Credflow?

Imagine a business- always stressed with increasing outstanding dues in the market, pressure from vendors and other creditors to pay off debts, managing operations, sourcing material and the list is endless! Now imagine the plight of millions of such businesses globally.

At Credflow, we are solving the SME’s most pressing problem of cash flow management. We are a full-stack cash flow management solution automating accounts receivables and building multiple stacks of financial solutions on top of that.

We have seen pretty good traction in the past few months, achieved product-market fit and are scaling fast. We already have more than 12 Lakh businesses on the Credflow network and more than INR 35,000cr worth of invoices on the platform. Above all, we have a gold mine waiting to be unlocked – the humongous amount of financial data flowing through our servers!

We have recently raised a $2.1 Million seed round from marquee VC Funds.

Here’s what Credflow offers in terms of functionality:

1) Powerful Automation (Eliminate Dependence on your Collection Managers and Automate your Collections)

– Automated Payment Reminders on SMS, Email, Call

– Auto sharing of Invoices with Debtors

– Auto allocation of Payments to Invoices

2) Understand Your Finance (Make Better Business Decision through deep insights about your business. Collate and view receivables in one place)

– Ageing Analysis of Debtors

– Avg Collection Periods, Debtor behaviour

– Projected Cashflows

3) Seamless Team Collaboration (Reduce dependence on your accounting department and distribute information seamlessly, even when remote)

– Give Access to Users Anywhere

– One Tap sharing of Information with Customers

– Create and manage task in CRM

– Track History of Communications with Customers

4) Powerful Cashflow Management (Make Better Business Decision through deep insights about your business. Collate and view receivables at one place)

– Create incentive scheme for Debtors

– Control credit extended and avoid bad debts

– Auto-generated business reports for Promoters

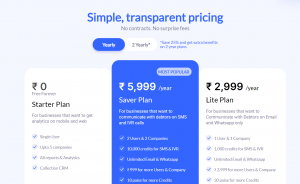

Plans and pricing:

PRICING DETAILS (Provided by Vendor):

- No free trial

- No free version

Credflow Reviews is borne out of the founders experience in the B2B aggregation space understanding that procurement is a finance first problem with working capital and cashflow management being the key pain-points. Credflow is a product of that understanding with the vision to revolutionize credit flow through the supply chain to help businesses grow exponentially – one vertical at a time.

Youtube – https://www.youtube.com/watch?v=VmSN-fR3mQY&t=1s

Vision

Revolutionise credit flow through the supply chain to help businesses grow exponentially – one vertical at a time

Aim

Develop efficient underwriting mechanisms using data. Enable business models to become working capital light.

CredFlow understands your problems – Currently we have acquired 10,000+ customers. Credflow is a product of that understanding with the vision to Revolutionise credit flow through the supply chain to help businesses grow exponentially – one vertical at a time.

Credflow is a vertical specific cashflow management solution CredFlow is a comprehensive cashflow management solution leveraging technology to build customised credit solutions and automate receivable collections.

About the founder — KUNAL AGGARWAL

Founder,CEO

B.Tech, Chemical Engg. IIT Delhi

Serial Entrepreneur

How we do what we do

Data Capture:

We get access to receivables and payables data of the anchors using our CredFlow product. We capture data as it flows through the supply chain end to end – one vertical at a time.

Feature Analysis – Leverage Numbers:

Using AI and ML, we leverage numbers to develop insights and intelligence earlier not possible building alternate underwriting mechanisms which are much more powerful.

Specification: Credflow

|

Product Enquiry

User Reviews

Only logged in customers who have purchased this product may leave a review.

- Features

- Ease of Use

- Value For Money

- Customer Support

There are no reviews yet.